In today’s fast-evolving landscape, business investment isn’t a luxury reserved for venture capitalists or Wall Street elites. With new digital tools and platforms, even solo entrepreneurs and small business owners can explore a range of accessible investment opportunities. Whether you’re looking to diversify your income, build long-term wealth, or simply dip your toes into a new venture, understanding how to invest in businesses has never been more attainable—or exciting.

Let’s break down seven practical investment avenues that cater specifically to agile, entrepreneurial spirits like yours.

1. Earn Through Commission-Based Ventures

You don’t need thousands of dollars to get started as an investor—sometimes, all it takes is your voice, your content, and your audience. Commission-based investments like affiliate marketing and dropshipping allow you to promote products or services and earn a slice of each sale, without owning part of the company.

- Affiliate Marketing involves embedding links in your blog, social media, or YouTube channel. When someone makes a purchase through your link, you earn a commission.

- Dropshipping enables you to sell products without handling inventory, using third-party suppliers who fulfill orders directly.

Courses like The Authority Site System or Udemy’s Build a Dropshipping Empire offer solid roadmaps to launch your efforts.

Why it works: Low cost, scalable, and ideal for online-savvy entrepreneurs looking for income streams that don’t require equity or large capital.

2. Support Local Growth with Peer-to-Peer Lending

If you’d rather play the role of a community-minded financier, peer-to-peer (P2P) lending platforms like Kiva and Honeycomb allow you to lend small amounts of money to individuals or small businesses in need.

You’ll earn interest on your loans—just like a bank would. Starting investments can be as low as $25, and your funds help power real-world dreams like opening a coffee shop or expanding a local bakery.

The upside: Social impact, portfolio diversification, and the satisfaction of watching businesses grow with your help.

Heads up: Be mindful of risk—borrowers can default, and returns aren’t guaranteed.

3. Go Long with Stocks and Index Funds

Looking for stability with potential high returns? Buy-and-hold investing in stocks or index funds might be your lane. This strategy centers around purchasing shares and letting them grow over time.

Your choices include:

- Individual Stocks: Buy shares in specific companies you believe in.

- Index Funds: Broader market exposure, like the S&P 500.

- Dividend Stocks: Earn recurring income as companies share their profits.

Why it works: Minimal day-to-day management, historically strong returns, and compounding gains over time.

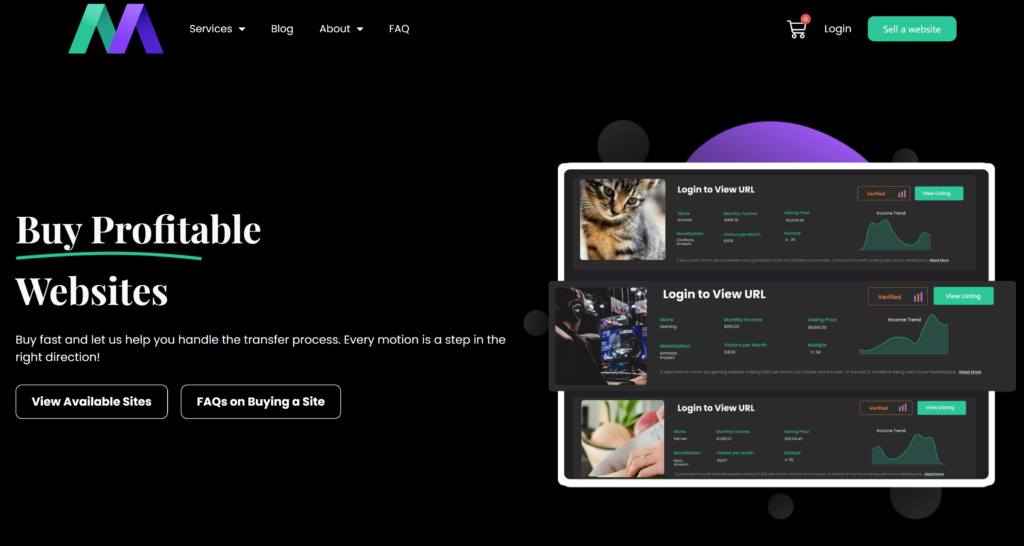

4. Buy a Revenue-Generating Website

Buying a profitable website can be like buying a digital storefront that’s already making money. Platforms such as MotionInvest list websites for sale across niches, often with manageable price tags.

How to start:

- Evaluate a site’s traffic, earnings, and growth.

- Conduct due diligence before buying.

- Once acquired, transfer ownership and start operating or optimizing it.

Why it’s attractive: Instant entry into digital business, passive income potential, and opportunities for growth through SEO, content, or new monetization strategies.

5. Micro-Invest with Mobile Apps

Don’t want to invest big chunks of cash? Micro-investing apps like Acorns, Stash, or Fundrise let you invest spare change or small regular deposits.

With features like automated round-ups or recurring investments, these apps offer a low-friction entry point into portfolios of stocks, bonds, and even real estate.

Perks include:

- Effortless diversification

- Hands-off management

- Built-in educational resources

Good for: New investors seeking passive income, long-term savings, or simple exposure to markets without a steep learning curve.

6. Team Up Through Entrepreneurial Partnerships

Sometimes, the best investment isn’t in a company—it’s in a person. Partnering with fellow entrepreneurs in a complementary field can help you co-launch ventures with shared responsibilities and profits.

Think of it like this: You’re a killer marketer. Your friend is a developer. Together, you build a SaaS tool, each contributing time, skills, and capital.

Keys to success:

- Align values and goals

- Define roles clearly

- Use legal agreements to formalize ownership and expectations

Why it’s compelling: Pooled resources, lower financial risk, and the ability to tackle bigger ideas together.

7. Embrace the Adventure of Angel Investing

If you’ve got a higher risk tolerance and a nose for promising ideas, angel investing could be your ticket to backing the next breakout brand.

Angel investors fund early-stage startups in exchange for equity. The payoffs can be huge if the company succeeds—but so are the risks.

Tips for aspiring angels:

- Focus on industries you understand

- Thoroughly vet the business plan

- Use platforms like AngelList to connect with vetted startups

Bonus: You may get involved beyond money—offering mentorship, advice, and strategic guidance.

Investing Is More Than Money: Don’t Overlook Sweat Equity

Not every business investment needs cash. Your skills, time, and effort—aka sweat equity—can be just as valuable. Whether you’re building a site from scratch or supporting a fledgling startup with your expertise, the time you invest can yield dividends in knowledge, reputation, and future earnings.

Final Thoughts: Is Business Investment Right for You?

Before diving into any investment, ask yourself:

- Can you afford to lose the money you invest?

- Do you understand the industry or business model?

- Are you looking for hands-on involvement or passive income?

- What’s your risk tolerance and time horizon?

Whether you start small with affiliate marketing or dive deep into angel investing, there’s a path for every entrepreneur. Explore the options, play to your strengths, and remember: the best investment might just be the one that grows you.